Subdron vessel damage assessments

(All images courtesy of Subdron)

Friends in deep places

Rory Jackson investigates one company’s unique technologies for consistently clear and high-quality analysis of vessel damage – particularly damage caused by grounding accidents

For six days in March 2021, the 400 m long container vessel Ever Given sat grounded in the Suez Canal. The majority of related news coverage delved busily into reasons for the grounding, the steps being taken to resolve it and its various consequences (especially those of the financial sort).

Relatively little was highlighted, however, of just how prolific ship groundings are, despite being the second most common type of commercial shipping accident. Dozens of commercial ships run aground every year, for reasons ranging from poor visibility conditions and darkness, to inaccurate or insufficient data on seabed geometries, and more. The consequences of such incidents can be severe and, in the worst cases, may result in loss of cargo, the ship, onboard equipment or even personnel.

Timely inspection and assessment of a ship’s hull are hence vital as a reaction to such damage and to prevent such losses. Traditionally, ship operators and owners will engage with teams of professional divers, although more recently they have started utilising ROV services.

The former is something of an unwieldy approach: standards typically require that a team of at least five divers must be hired, whose operations naturally require extensive organisation and planning. Additionally, each diver can only remain in the water for around 1–2 hours at a time owing to safety regulations and oxygen limits, hampering the efficiency of their data gathering.

That data gathering in turn is – compared with that of ROVs and autonomous UUVs – often outdated. Divers will normally use cameras or just their hands to assess areas of damage, and although they can take excellent spot measurements, this tends to be a very manual and time-consuming process, and rarely will such teams check the entirety of a 600 m freighter. Instead, they will likely take several days to make a general, and hence incomplete, assessment of damage (as well as other physical issues such as biofouling) based on a stratified sample of measurements, with perhaps 10–20 photographs of specific areas scattered along the vessel’s length.

ROVs can conduct far more comprehensive vessel hull inspections, with the use of sonars and other sensors providing greater detail. However, their often immense weight, limited speed and manual control regime make them slow to set up, deploy and operate. That slowness combined with their significant operating costs reduces the degree of their advantageousness over divers. Furthermore, being remotely operated, ROV pilots have to work by ‘feel’ and experience to ensure measurements around vessels’ hulls are taken at consistent margins, speeds, resolutions and so on, and to ensure accurate assessment of damage and fouling – which, obviously, cannot be scientifically guaranteed.

Austria-headquartered Subdron, however, has honed its AUV technologies, not only around the ease of deploying and operating the light, autonomous subsea inspection vehicle at the heart of its ‘v.dron’ ship inspection service, but also around its unique Relative Object Navigation (RON) approach to ensuring extremely precise and consistent measurements across large ships (as well as fixed subsea infrastructure).

“With our AUVs, we first propose to gather such data autonomously and also much faster and cheaper than can be done with divers and ROVs,” says Arnau Carrera, CTO at Subdron.

“Then, with our RON technology, we can continuously localise our AUV much more precisely than other approaches we’ve seen for subsea localisation, which means we can obtain consistent data batches without any error greater than 5 cm. So, ship and fleet operators can trust that we’ll inform them exactly where to find items of concern across their hulls and clear detail on the nature of those items.”

Those items can include grounding-related damage, collision-related damage and biofouling, enabling not just reactive maintenance but preventative, predictive work to extend a ship’s lifespan without incurring major repair work.

“As well as the very precise and trustworthy data collection, we also provide the processing of all data sets including very dense sonar point clouds, and a certain ease-of-use with no training or infrastructure needed for our AUV operations – unlike ROVs – and automation in both operations and planning, enabling full 3D ship reconstructions in far less time than conventional inspection works,” Carrera adds.

Sparus and RON

Theoretically, there are many AUVs that Subdron could use both as a vehicle for its commercial services and as a carrier for its own technological IP. As of writing, its preferred (and sole) model of AUV is the Sparus II from IQUA Robotics, a company that we previously featured in issue 56 (June/July 2024) for its SoundTiles acoustic processing software.

“The Sparus II has a maximum depth rating of 200 m, an operating endurance of 8–10 hours normally, a speed range from 0 to 4 knots; it weighs 52 kg in air, and its length is 1.6 m, with a body width of 23 cm,” Carrera states.

“For general operations and the logistical efficiency of our services, the AUV works nicely, but just as one might add mods onto a very good car or computer, so do we install sensors and other hardware into the Sparus II, which is engineered conveniently for developers to that effect.”

The Sparus II’s tube-shaped fuselage is predominantly white, along roughly two thirds of its length from the aft. That white section is a sealed pressure vessel, off-limits to integrators and non-IQUA technicians. The yellow nose section, however, is a flooded and open bay, presenting an approximately 50 x 23 cm cylindrical space for payload installations and other modifications.

As a side note, the AUV features two thruster nacelles, external to and either side of the fuselage, with additively printed propellers (of the conventional hub-driven type) and magnetic couplings of IQUA’s own design; these are also closed systems.

One can surmise, hence, that the hardware necessary for RON is installed in the yellow section normally utilised for payloads. The technology was invented by Thomas Vonach, CEO and founder of Subdron, and fully developed in-house. Subdron’s r&d here also benefited from external advice and general support by the Fraunhofer Institute.

“They created and optimised this technology with the idea that to understand an underwater environment, it was more important to accurately track your proximity to local objects, than tracking where you were on a global scale,” Carrera explains.

Hence, the Subdron team’s r&d was greatly focused, in its early years, on how an underwater vehicle could achieve a full and detailed real-time assessment of everything around it by obtaining copious sensor data and fusing it into a reliable 3D model of the UUV’s surroundings. That included tracking the lines and shapes of objects to be inspected as part of commercial services, as well as those of non-imperative objects to use as points of reference in real-time localisation.

“But of course, tracking huge amounts of data on the surroundings would take a lot of processing power and storage,” Carrera notes. “So, much of the intelligence and efficiency of RON, as it’s engineered today, comes from how it doesn’t track everything, but instead focuses on just enough identifiable elements around the AUV.

“That prevents its navigation from performing the kinds of changes in position or orientation that could affect data quality – something that happens quite often when AUVs rely solely on preplanned navigation trajectories and waypoints for specific latitudes, longitudes and depths. It’s very easy to drift half a metre, or collide with objects, and for such incidents to go unaccounted- and uncorrected-for in the resulting data products.”

Smart planning

Before deployment, the AUV’s subsystems – such as sensors and computers – can be checked automatically from the operator’s console, multiple times over, as long as they are connected into the vehicle correctly and connection to the console is maintained, either by wi-fi or via an Ethernet umbilical.

A few other tests must be performed directly, such as checking for obstructions to the propellers – meaning both visual checks and mechanical spin tests, with the latter confirming good performance and the absence of smaller obstructions that could escape the eye. Vacuum tests might also be run, among a few other lower-duty checks, to confirm that the pressure vessel has no leaks.

Given the Sparus II’s all-up weight in air of 52 kg, the AUV is effectively hand-portable by two persons and hence, theoretically, the system can be deployed and operated in any water body, including harbours, rivers and open ocean conditions, should a ship or fleet operator wish for inspection work rapidly following an incident.

“The key thing is that the ship is moored or anchored, to prevent it from moving too much; we can deal with it moving a bit, but as the AUV’s top speed is 4 knots, if there’s any cruising, acceleration or attitude changes on the ship’s part that are faster than that, we won’t be able to keep up, follow or perform avoidance manoeuvres, regardless of navigation intelligence,” Carrera muses.

“In any case, the ship being static maximises our ability to collect quality data. But apart from that, there’s no real restrictions on where we can operate. Maybe our cameras work a little less effectively in harbours owing to reduced visibility from pollution and shadows, as other systems’ cameras would, but there’s potential for a CONOPS [Concept of Operations] in which we collaborate with teams of divers, and they ferry the AUV out on their boats to anchored vessels in need of inspection or provide some remote illumination in specific areas with low visibility.”

While the Sparus II can be deployed with a crane if one is available, cranes are not a strict requirement. If aboard a ship or on a harbourside with slipways, a small trailer will suffice for lowering the AUV into the water. However, given the AUV’s low weight (relative to industrial ROVs), it can simply be lowered by hand if the operators are positioned close to the water – for instance, in a rigid inflatable boat or on a beach.

As mentioned, Subdron’s approach to inspections relies more on its RON technology (to be explained shortly) than on strict navigation of preset waypoint paths; some pre-programming is necessary, however.

“What we first need the user to define is an initial coordinate where the AUV’s mission will start. Then, we need them to input the length of the ship, as well as some other general characteristics of the area they want to inspect, to give an overall approximation of how much of the ship is underwater, so that the AUV can know how much of the ship it’s supposed to be seeing,” Carrera explains.

Once accurate information has been input regarding these operational characteristics, the logic Subdron has programmed into the AUV’s computer then enables it to calculate the distances it will navigate to and around the ship, how much of its sensor FoVs should be occupied by the ship at each stage of the inspection, how many passes and lines about the hull it needs to do and, therefore, the trajectories it will keep to during its approach, survey and return.

“Though of course, the system can adapt and transform these parameters during the mission,” Carrera continues. “Overall, the intelligence inherent to our planning software prevents the need for the user to directly plan or intervene on the AUV’s trajectories. If they needed to input, say, the correct depth for every pass or the exact survey speed at each point, that’s very cerebral and tedious work, meaning they could easily make mistakes.

“With our approach, the room for errors and the requirements of operators’ mental energy are limited to just defining the starting point and the ship; if there’s something like 5 m of difference between those parameters in the planning map and in reality, the AI in RON will still understand that the ship is the correct ship, despite being farther away or turned at a slightly unexpected angle, and the AUV will update its trajectories to still approach correctly and maintain the specified survey path – maybe with a 1.5 m locus from the hull, for example.”

Staying flexible

As indicated, Subdron’s IQUA Sparus II AUVs calculate and adjust their navigation paths in real time using the combination of hardware and software that constitutes RON.

Much of the hardware is composed of sensors, which are chosen and swapped in and out of the yellow payload nose depending on the nature of the mission at hand. For inspecting vessel hull damage, the paramount sensors are a pair of mechanically rotating ISS360 sonars from Impact Subsea; as their name implies, these scan in a 360° FoV and with 90 m of effective range.

They can additionally sense (and thus compensate) for pitch and roll, accurate to 0.2° and with a sensing resolution of 0.1°. The model was, however, most principally designed for minimised SWaP, being a 0.3 kg device that consumes 95 mA at standby and 240 mA when scanning, with a 700 kHz nominal operating frequency and 2.5 mm minimum resolution.

“We orient the two ISS360s to cover both the horizontal and vertical axes; the vertical ensures we cover hull walls and bottoms effectively, while also ascertaining and tracking the shape of the ship over time,” Carrera says.

“The horizontal meanwhile observes how the ship’s shape is evolving ahead and rearward of the AUV, so it can understand whereabouts along the ship’s length it is, validate where it has come from, and keep planning where it is headed next, especially if the sonar data gathering is occasionally interrupted by surfacing to regain an RTK-GNSS position fix. Together, the two sonars ensure we keep a precise distance between us and the ship, and thus a consistent quality and control of data.”

Subdron also integrates one of Imagenex’s DeltaT series multibeam echosounders, with 2250 kHz standard scanning frequency. While that may be an unusually high frequency compared with the typical 400–800 kHz used in bathymetry applications, it enables very-high-resolution scans over short distances.

The multibeam echosounder in question originated as a modification on Imagenex’s existing sonar tech, utilising the same transducer type as in its DT360Xi. Although originally developed for another project that did not move forward, it is still sold by Imagenex to any customers who asks, and it fitted Subdron’s needs perfectly (who inform us that they acquired their most recent units at the beginning of 2025).

“This allows us spot measurements of, for example, more than 10,000 points in a square metre area, which enables us to bring really clear images of damage to ship owners,” Carrera continues.

For added colouration and detail – particularly for biofouling analyses – Subdron will also integrate underwater cameras. To that end, it is focusing some r&d on a SWaP-optimised solution that packages a camera and sonar together.

Specifically, Subdron is utilising the cameras from DeepWater Exploration, Inc. in California, which are engineered expressly for autonomous hydrography applications through the integration of USB 2.0 for plug-and-play installation, anodised alloys for pressure and corrosion resistance, and proprietary lens assemblies and coatings for minimising glare, ghosting, distortion and chromatic aberration issues typically faced by subsea vision solutions. The US supplier also claims its camera processing technology enables a latency within 20 ms, to enable quick real-time decision-making by autonomous survey vehicles.

As Carrera explains, “The goal with this upcoming payload package is to have a mixture of sonar data with colourised hi-res images overlaid; the latter complementing and aiding aspects of damage or biofouling, which asset owners might not understand with just the 3D sonar model alone.”

While exact navigation speeds depend on the mission profile, particularly the density and resolution demands on the customer’s part, Subdron typically surveys at 0.2 m/s as an optimal speed for gathering highly detailed acoustic data, which get stored on a 1 TB hard drive onboard (and this can be swapped for a larger one if ever a mission risks bringing the AUV close to its storage capacity before surfacing).

“Each sonar pulse gets something like a pixel-thick line of data as you move; it’s not like a camera, where you capture a big square image which then overlaps nicely with the next one for easy stitching of mosaics. Using imaging sonars forces you to go very slowly to capture all aspects of something you’re trying to survey,” Carrera notes.

“If it were physically possible to rely on underwater cameras alone, then AUVs could go much faster and capture the necessary data quicker; but our next-gen payloads will achieve better, more actionable combinations of camera and sonar data without slowing down, and with future software optimisations we should be able to process data faster, and thereby move faster.”

Under the sea, in the cloud

Recovery of the AUV can, similarly to deployment, be done either by crane or by a lower-duty approach such as manual lifting from the water. Afterwards, maintenance can be performed, but Subdron informs us that the Sparus II’s maintenance requirements are minimal; some removal and cleaning of the thrusters may take place to prolong the lifespan of the propellers and magnetic bearings against sources of corrosion such as sand or pollutants, and anodes for galvanic protection will also likely be checked to ensure the ongoing integrity of those and the internal systems they safeguard.

Other than these, however, Subdron tends to perform a full, general maintenance check for required repairs and overhauls every six months; hence, the team can quickly move from post-survey maintenance to the task of data processing.

A modicum of processing power in the Sparus II AUV’s computer system is dedicated to real-time onboard processing of sensor data specifically for navigation purposes, thereby enabling the dynamic course optimisation that is key to RON’s optimised subsea data collection.

“But we don’t process data for the client onboard the AUV; naturally, the AUV needs to understand the position and attitude of the ship at all times, so that can’t be outsourced to a cloud or postponed until post-processing is underway,” Carrera says.

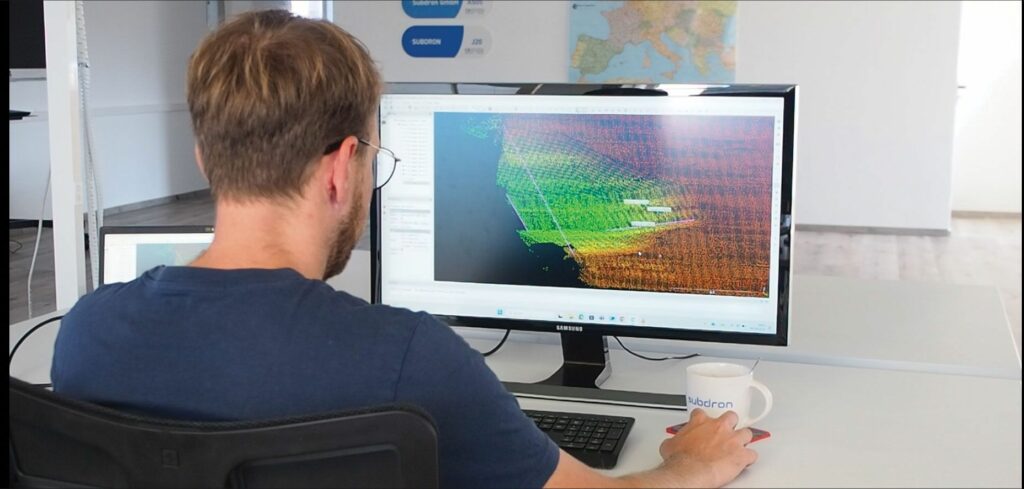

“The heavier aspects of generating our data products, however, including all manners of converting the acoustic data into 3D point clouds representative of customers’ ships and their condition, must be done outside of the vehicle, given that the amount of data these processes may generate and the degree of processing power needed cannot efficiently fit inside the AUV.”

Subdron’s long-term vision for its v.dron service’s CONOPS includes having the Sparus II (or any other AUVs the Austrian company may choose to leverage) surface for a cellular internet connection, so that the raw, unprocessed sonar and camera data can be delivered to a cloud. There, faster technologies (than the methods currently utilised) for processing the data are to be deployed, and the client will be able to access those data remotely, regardless of their location in the world, as well as monitoring the point cloud generation process for their own peace of mind.

The company’s engineers are, as of writing, optimising their own proprietary algorithms for cloud-based processing of sonar and camera data. It additionally owns and operates a private cloud server, powered by its own dedicated computers, which will be key for initial deployment as part of v.dron and other AUV services Subdron offers.

“Building our cloud first required networking two reasonably normal desktop computers with powerful graphics cards, and then we used Citrix GUI to optimise the server,” Carrera recounts.

“That ranged from minor things like optimising the visualisations to make it comfortable to work with, to ensuring connection security in order to prevent our data or our clients’ data from getting leaked.”

Further down the road, however, Subdron anticipates switching from its own cloud to either AWS, Azure Maps or another major industrial cloud service provider with applicability for geospatial and hydrographic data hosting, particularly to yield improvements toward scalability and ease of maintenance. Such providers’ use of machine learning to accelerate data processing is also expected to bring service quality benefits as Subdron takes on larger or more data-dense survey projects.

To distant shores

One can surmise that there are various other applications to which the technologies inherent to Subdron’s RON and v.dron capabilities are well suited. Some currently offered include bathymetry and side-scan sonar surveys for a range of assets, as well as port wall inspections (referred to by the company as ‘p.dron’) in which the Sparus II can scan up to 1–2 km of a quay wall within 8–12 hours (depending on customer requirements on data resolution).

“There are a couple of other mission types that have been asked of us and that we’ve been able to explore. One is hydroelectric dams and power plants, which we’ve already adapted our technology towards,” Carrera says.

“Another is underwater pipe or cable inspections; we’re confident some minor adaptations are all it’ll take to have our AUVs follow such infrastructure, centring the pipe or cable in the correct position to ensure consistent and high-resolution scanning of it. Transatlantic and Baltic cables would likely be out of this AUV’s reach, however, so we’d likely need to get a bigger vehicle before engaging at that scale.”

Further ahead, Subdron is also looking beyond riverine, lake-based and coastal operations. Wind farms pose one such area of interest, given their constant need for inspections and maintenance with regard to structural integrity and biofouling, particularly because biofouling can upset the weight distribution of the foundations of the wind farm turbine.

“Surveying deeper infrastructure requires either much more expensive AUVs for diving deeper – which wouldn’t be good for the prices of our services – or, the more likely approach we’ll take, different kinds of sensors, like magnetometers or sub-bottom profilers, especially because offshore asset managers want to put cables and other systems below the seabed, where they’ll be protected from corrosion but where cameras and imaging sonars can’t inspect them,” Carrera continues.

“Until then, we’ll likely start with surveys that take our preferred AUV down to its depth limits at 100–200 m deep, and thereby provide as much value as we can from the platform that we have; when we’re regularly performing at the limit of what Sparus II can do, then we’ll consider diversifying our fleet as a natural next step in scaling-up our services.”

The company is also constantly watching the subsea industry for new sensors, and is eyeing 3D sonars in particular as new products in that vein are released in smaller sizes and with lower power consumption; the 3D-15 from Water Linked, for example, is cited as a prominent example of such innovations that Subdron is waiting to receive, integrate and trial for its capabilities.

“This kind of sonar will likely help us significantly in increasing the speed and density with which we can gather data,” Carrera says. “Testing it in our AUVs will make much clearer just how far and in what ways it could improve our data quality, but from our initial impressions and discussions with Water Linked, it looks like very promising tech.”

Key suppliers

AUV platform: IQUA Robotics

Sonars (mechanically rotating): Impact Subsea

Multibeam echosounder: Imagenex

Subsea cameras: DeepWater Exploration Inc.

UPCOMING EVENTS